Turning a brilliant idea into a successful startup requires more than just creativity or a stroke of genius. It demands a combination of innovation, perseverance, strategic thinking—and, perhaps most importantly, access to the right type of funding.

Getting funding right can mean the difference between a business that flourishes and one that struggles to survive. However, before diving into specific funding sources, there are some fundamental principles every entrepreneur should embrace

Principles to Keep in Mind When Funding Your Startup

1. Budgeting Matters

No matter the source of funding—whether it’s your own savings, investors, or a crowdfunding campaign—having a detailed, realistic budget is essential. Keep track of all income and expenses, and revisit your budget regularly to ensure you’re on track.

2. Prioritize Essential Expenditures

Startups have limited resources, so it’s critical to spend wisely. Focus on what directly contributes to growing your business and generating revenue. Avoid unnecessary costs, and always separate your personal finances from your business accounts.

3. Be Creative and Resourceful

Funding doesn’t always have to come from money. Look for innovative ways to generate revenue and leverage existing assets. Partnerships and collaborations can give you access to resources without requiring significant financial investment.

4. Seek Cost-Effective Solutions

Technology has democratized access to tools that were once expensive. Free or lowcost software, open-source platforms, and co-working spaces can help you run your business efficiently without breaking the bank.

5. Learn from Experienced Entrepreneurs

No matter how unique your idea may seem, every startup faces similar challenges. Connect with founders who have successfully built businesses. Learn from their experiences, ask for advice, and apply their strategies where relevant

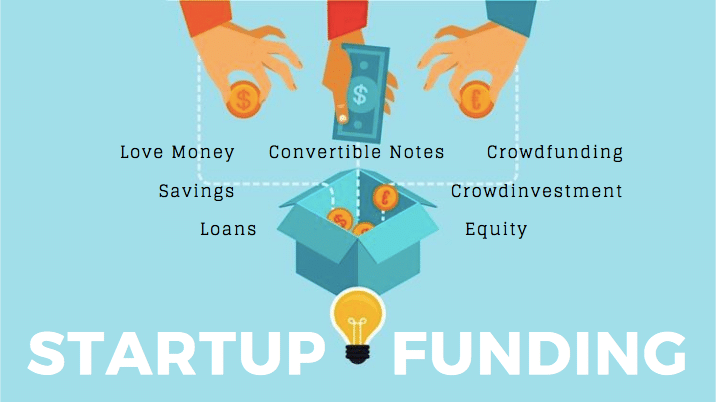

Common Types of Startup Funding

When it comes to funding, startups generally fall into five main categories:

1. Self-funding (bootstrapping)

2. Crowdfunding

3. Angel investing

4. Venture capital

5. Series funding

In this article, we’ll focus on self-funding, often the first step for many entrepreneurs.

Self-Funding: Bootstrapping Your Startup

Self-funding, also known as bootstrapping, refers to using personal savings, personal loans, or revenue generated from your business to finance operations and growth. It’s a common path for entrepreneurs who want to start and grow a business without depending on external investors.

Advantages of Bootstrapping

1. Control and Independence

When you self-fund, you retain full control over your business. Strategic decisions, branding, and the direction of your company are entirely in your hands. You don’t have to answer to investors or compromise on your vision.

2. Flexibility and Agility

Bootstrapped startups can adapt quickly to changes in the market. Since there are no investor expectations to meet, you can pivot your business, test new ideas, and respond to customer feedback without lengthy approval processes.

3. Focus on Revenue Generation

Without the pressure of paying back investors or meeting aggressive growth targets, bootstrapped founders can focus on generating sustainable revenue. This approach often leads to a stable, self-sufficient business model that is less dependent on outside funding.

Challenges of Bootstrapping

1. Limited Resources

Bootstrapping often means working with tight finances, which can limit growth opportunities. It may be harder to hire top talent, invest in marketing, or scale operations quickly.

2. Slower Growth Trajectory

Without large capital injections, your business may grow more slowly compared to venture-backed competitors. Rapid expansion may not be possible until your business generates sufficient revenue.

3. Financial Risk

Self-funding puts your personal finances on the line. If your business struggles, you risk losing your savings or taking on debt to keep it afloat.

Tips for Bootstrapped Entrepreneurs

Even though bootstrapping has its limitations, it can be highly rewarding if managed correctly. Here are some practical tips:

• Keep a Close Eye on Cash Flow: Track every dollar spent and earned. Cash flow is thelifeline of a bootstrapped business.

• Invest Wisely: Prioritize investments that directly support growth or revenue generation.

• Leverage Free and Low-Cost Resources: Use open-source tools, free templates, andshared workspaces to reduce overhead costs.

• Generate Early Revenue: Start monetizing as soon as possible. Even small revenuestreams can reduce reliance on personal funds.

• Network Relentlessly: Build relationships with mentors, potential partners, and otherentrepreneurs. Their guidance can save time, money, and mistakes.

Real-Life Bootstrapping Examples

• Shopify Founders: Tobias Lütke and Scott Lake started their e-commerce platform byfunding the initial development with personal savings. They focused on revenuegeneration from day one, gradually scaling without external investment.

• Local Small Businesses: Many small businesses in Zimbabwe begin by fundingthemselves with personal savings or family contributions. By keeping expenses low andreinvesting profits, they often grow into sustainable ventures without needing externalcapital.

Bootstrapping is challenging, but it builds resilience, discipline, and a deep understanding of your business. It teaches entrepreneurs to be resourceful, make smart decisions, and prioritize what truly matters.

Key Takeaways

• There’s no single “right” way to fund a startup. The best approach depends on yourgoals, business model, and growth plans.

• Self-funding is ideal for entrepreneurs who value independence and want full controlover their business.

• The main challenge of bootstrapping is limited resources, but careful planning andcreative problem-solving can overcome many obstacles.

• Every type of funding, from crowdfunding to venture capital, has its own pros and cons.Understanding them allows you to choose the option that aligns with your vision andstrategy.

Remember: building a successful startup is as much about smart resource management as it is about having a great idea. By mastering the art of self-funding and combining it with innovation and strategic planning, you can lay a strong foundation for your business—even before seeking external funding.